Mark Carney and the Asset Stripping of Europe & Canada

Jan 23, 2026No time for the full 52m video? Watch the 14-minute AI-generated TL;DR summary instead.

Hey hey Sovereign Wealth Builders.

If you’ve ever watched the parade of global leaders at the World Economic Forum and felt like you were watching a stage play, you’re not wrong. Their carefully crafted speeches are a form of theater, a grand performance designed to distract from a much deeper agenda: the controlled demolition of the West to facilitate the rise of a multipolar world order managed by a transnational elite.

This post cuts through the official narratives to do one thing: follow the money. It is the essential summary—the TLDR—of the deep-dive analysis I delivered in the second part of my recent livestream. We’re going to decode what leaders like Mark Carney are really signaling about the future of Europe and Canada and expose the machinery of the global asset stripping exercise that is currently underway.

This analysis is taken from Part 2 of the SimonDixonHardTalk LIVE stream titled "Mark Carney and the Asset Stripping of Europe & Canada". The full 3-hour, 19-minute broadcast aired live on YouTube, X, and Rumble. This article focuses on the 52-minute analysis of Europe and Canada.

1. The Great Deception: Why They're Finally Admitting the "Rules-Based Order" is a Lie

One of the most revealing signals from Davos is that leaders are now openly admitting that the "rules-based international order" is a fiction. This isn't a moment of rebellion; it's a deliberate and necessary narrative shift. They no longer need to pretend that powerful nations follow international law because the old system is being dismantled.

The motive is strategic: to deconstruct the old power structures and redeploy them in a raw, unapologetic new form for transnational capital, using populist narratives as a distraction. As America strategically downsizes from its role as global hegemon, this new era will be managed not by nations, but by the transnational Financial Industrial Complex (FIC). The admission that the old rules are dead is the signal that the transition is entering its next phase.

This was captured in a key clip from the proceedings:

"...we live in an era of great power rivalry that the rules-based order is fading that the strong can do what they can and the weak must suffer what they must..."

2. The Illusion of Conflict: How European and American Leaders Serve the Same Masters

On the surface, we see conflict. Germany's Friedrich Merz calls for European military independence, while leaders like Trump project overwhelming American strength. This is manufactured "strategic tension"—a perfect example of the controlled chaos required to achieve a financial objective.

The unified agenda behind this theater is to push for massively increased defense spending. European leaders argue they need their own military to be independent of America. American leaders argue the world is dangerous and they need to sell more weapons. Both paths lead to the same destination: money printed by the European Central Bank is used to buy weapons from the US Military-Industrial Complex (MIC). Following the money reveals the specific plumbing of this operation: it drains those euro dollars, repatriates those dollars home, and is used to prop up the US stock market and defense stocks.

Whether you gravitate to the "America is a bully" narrative or the "Trump is draining the swamp" narrative, you are serving the same agenda: enriching the FIC while your nation is left with all the debt.

3. Europe's Grim Future: A "Suicide Mission" of Total Vassalization

Let's be direct: partnering with the European Union at this stage is a "suicide mission." According to my analysis, there is no coming back for Europe.

Europe isn't just a victim; it's a player that was checkmated. It had a chance to diversify by partnering with BRICS—specifically with Russia for its energy needs—but was manipulated into the Ukraine conflict instead. Now, it's too late. The BRICS nations and the Gulf sovereign wealth funds have already set their alliances. Europe is positioned as the primary sacrifice in this global shift, left without a seat at the table where the new world order is being negotiated. It faces a terminal demographic crisis, a mass exodus of its wealthy citizens, and a welfare state collapsing under its own weight.

Speeches from leaders like Zelenskyy are now just a tired sales pitch, a performance used to perpetuate a state of crisis and ensure European money continues its one-way flow into the US defense sector, accelerating Europe’s decline.

4. The Real Prize: Why Everyone is Suddenly Fighting Over Greenland

The sudden focus on Greenland is not a random geopolitical sideshow. It is a central piece in the global resource grab being orchestrated by transnational capital. Greenland’s strategic value comes down to two critical factors:

- Rare Earth Minerals: It holds one of the world's largest untapped deposits of minerals essential for the Technical Industrial Complex (TIC). These materials are required for batteries, electronics, and electric vehicles. Securing them is a direct, long-term (10-20 year) strategic move to challenge China's current monopoly and fuel the FIC’s technological ambitions independent of current supply chains.

- New Shipping Routes: As the Arctic ice melts, Greenland opens up new, faster, and more efficient trade corridors between America and Europe, fundamentally rerouting global logistics.

The struggle over Greenland, alongside Venezuela and Ukraine, is part of a single, coordinated operation. It is about carving up the world's most valuable resources and logistics routes for the benefit of the global financial elite, leaving nation-states to manage the fallout.

5. Meet Europe's New Landlords: BlackRock and the Sovereign Wealth Funds

The "asset stripping exercise" in Europe is not being managed by elected politicians. They are acting as middle-managers, tasked with performing the political theater required to sell the agenda to the public. The real power lies with the entities that will own the continent: entities like BlackRock and, crucially, Norway's Sovereign Wealth Fund, which are the key managers of this transition.

In the emerging European order, it will be Switzerland and Norway that are essentially the most important nodes in the network for managing the asset stripping exercise. Their strategy is one of controlled chaos. They do not want total economic collapse or all-out war, as that would destroy their investments in European stocks and real estate. Instead, they foster a state of managed tension—using civil unrest, demographic crises, and regional conflicts as justification to ramp up defense spending and roll out the architecture of the global surveillance state: digital IDs, Central Bank Digital Currencies (CBDCs), and pre-crime technology.

The objective is the gradual erosion of the European Union to accelerate the transfer of assets, ownership, and control directly to these global financial powers.

Conclusion: Your Invitation to the Multipolar World

The world is undergoing a managed transition to a multipolar order, a controlled demolition orchestrated not by presidents and prime ministers, but by a global financial elite. The political theater you see on the world stage is a distraction, performed by national leaders acting as managers to facilitate the asset stripping of the West. They are there to create narratives, take the blame, and ensure the process continues uninterrupted.

This global theater is designed to keep you distracted while your wealth is systemically stripped away. The only question that matters is: What are you doing to build your own sovereign wealth outside their control?

Take Action & Follow the Money

- Share this post. Help others understand the bigger picture beyond the media narratives.

- Subscribe to the Simon Dixon YouTube channel. Get my weekly deep dives into geopolitics, macro, and Bitcoin. Subscribe to my YouTube channel.

- Find me on Rumble. This is my backup channel, safe from censorship. Follow me on Rumble.

- Follow me on X @SimonDixonTwitt. I post real-time updates and analysis on X and am highly active there. Follow me on X.

- Follow me on instagram. Usually short clips are posted here.

- Follow me on TikTok. Usually short clips are posted here.

- SimonDixon.com. This is my personal site and an archive of all my content, safe from de-platforming. Join the free membership portal.

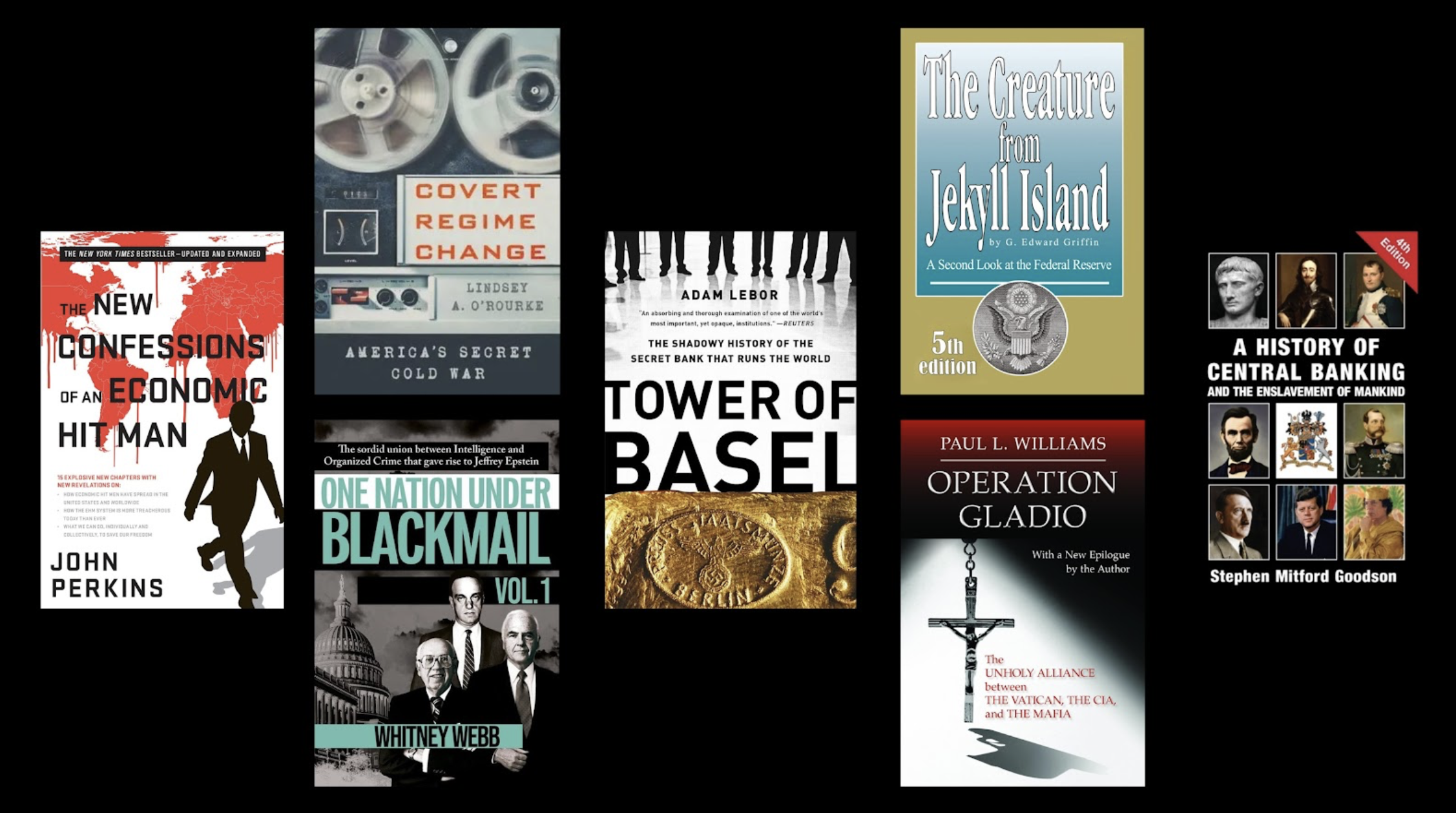

If you want the list of books I mentioned in the stream, like Confessions of an Economic Hitman and The Creature from Jekyll Island, here is a starting reading list.

Watch on YouTube

Read Related Blogs

Disclaimer

This article represents an interpretation of complex financial and geopolitical events based on the analysis presented in the SimonDixonHardTalk LIVE broadcast. The content is for educational and informational purposes only and does not constitute financial, legal, or investment advice. The views expressed are based on a "follow the money" framework and are speculative in nature. Readers are urged to conduct their own thorough research and consult with professional advisors before making any financial decisions. This analysis is a framework for understanding global shifts, not a definitive prediction of future events.