Hijacking Bitcoin? Simon Dixon vs Steve Patterson – BTC vs BCH Infiltration Debate

Feb 13, 2026Hey hey Sovereign Wealth Builders,

There is a pervasive, gut-wrenching feeling in our industry today: the sense that Bitcoin has been "Wall Street-ified." What began as a Cypherpunk revolution for individual sovereignty has, in many ways, been captured by the very "Empire" it was designed to bypass. Between the degenerate gambling, massive institutional leverage, and the slow creep of the legacy banking system, many are left wondering: was Bitcoin hijacked from the inside, or has the original vision survived the onslaught?

This post is the essential TLDR of the Part 2 segment (beginning at the 1 hour and 40 minute mark) of the "SimonDixonHardTalk" livestream aired on February 13, 2026, across YouTube, X, and Rumble. The full 3-hour and 50-minute livestream was titled "Was Bitcoin Hijacked? | SimonDixonHardTalk LIVE | 13 FEB 2026." In this session, I sat down with Steve Patterson to debate the high-level alleged infiltration attempts that have plagued the protocol.

The Infiltration Reality: A Global "Divide and Conquer" Strategy

In the historical war between "Big Blockers" (BCH) and "Small Blockers" (BTC), most participants are looking for a side to vindicate them. However, the Hard Talk reality is that the evidence suggests a massive "divide and conquer" strategy that targeted the entire community. This was not a binary battle; it was a sophisticated campaign to fracture the movement.

The most plausible theory is that Bitcoin was permitted to grow as a "gateway drug." The Empire—comprised of intelligence agencies and the global financial industrial complex—needed a proof-of-concept to build the architecture for the "Digital Dollar nightmare" (CBDCs, stablecoins and social credit scores). They used our innovation to refine the digital wallets and blockchain ledgers required for a programmable, Orwellian surveillance system.

Infiltration was absolute on all sides. We see this in the pivot of figures like Mike Hearn, a prominent "Big Blocker" who transitioned to R3 to build "bank blockchains" and pushed for on-chain KYC. This illustrates that the narrative was being steered toward a version of the technology that the legacy system could eventually control, regardless of block size.

The Timeline of Exit: 2011 and the "Wasp Nest"

The timeline of April 2011 is critical to understanding the project's leadership shift. On April 23, 2011, Satoshi Nakamoto sent his final email. Only four days later, on April 27, Gavin Andresen publicly announced he was heading to the CIA to give a talk on Bitcoin.

It is my interpretation of the evidence that Satoshi likely knew Gavin was engaging with intelligence agencies before the public announcement was made. Seeing that Gavin was about to "kick the wasp nest," Satoshi exited to protect the project's decentralization and remove the "CEO" figurehead the state could target. This period also coincides with the tragic death of cryptographer Len Sassaman, who, in my opinion, remains one of the most compelling candidates for Satoshi.

"I’ve moved on to other things. It’s in good hands with Gavin and everyone." — Satoshi Nakamoto, April 23, 2011.

The 2014 Pivot: Foundation Collapse and Institutional Entry

If 2011 was the year of Satoshi’s exit, 2014 was the "disaster year" for Bitcoin's foundational structure. Much like the later FTX collapse but at a more fundamental level, the Bitcoin Foundation was systematically dismantled. Board members like Mark Karpeles and Charlie Shrem were either discredited or removed by the state.

With the Foundation in shambles, development funding hard-pivoted toward the MIT Digital Currency Initiative and corporate shells like Blockstream. While this "professionalization" brought in resources, it also created a corporate "wrapper." Developers became subordinate to shareholders and fiduciary duties rather than the community. This created a layer of plausible deniability for institutional capture.

Allegations and "Bad Actors": Navigating the Compromised Networks

Discussing the figures who shaped this era requires high legal caution. It is my interpretation of the evidence and public debate that individuals such as Adam Back, Brock Pierce, Craig Wright, and Peter Todd have reportedly played roles that destabilized the original mission of the project.

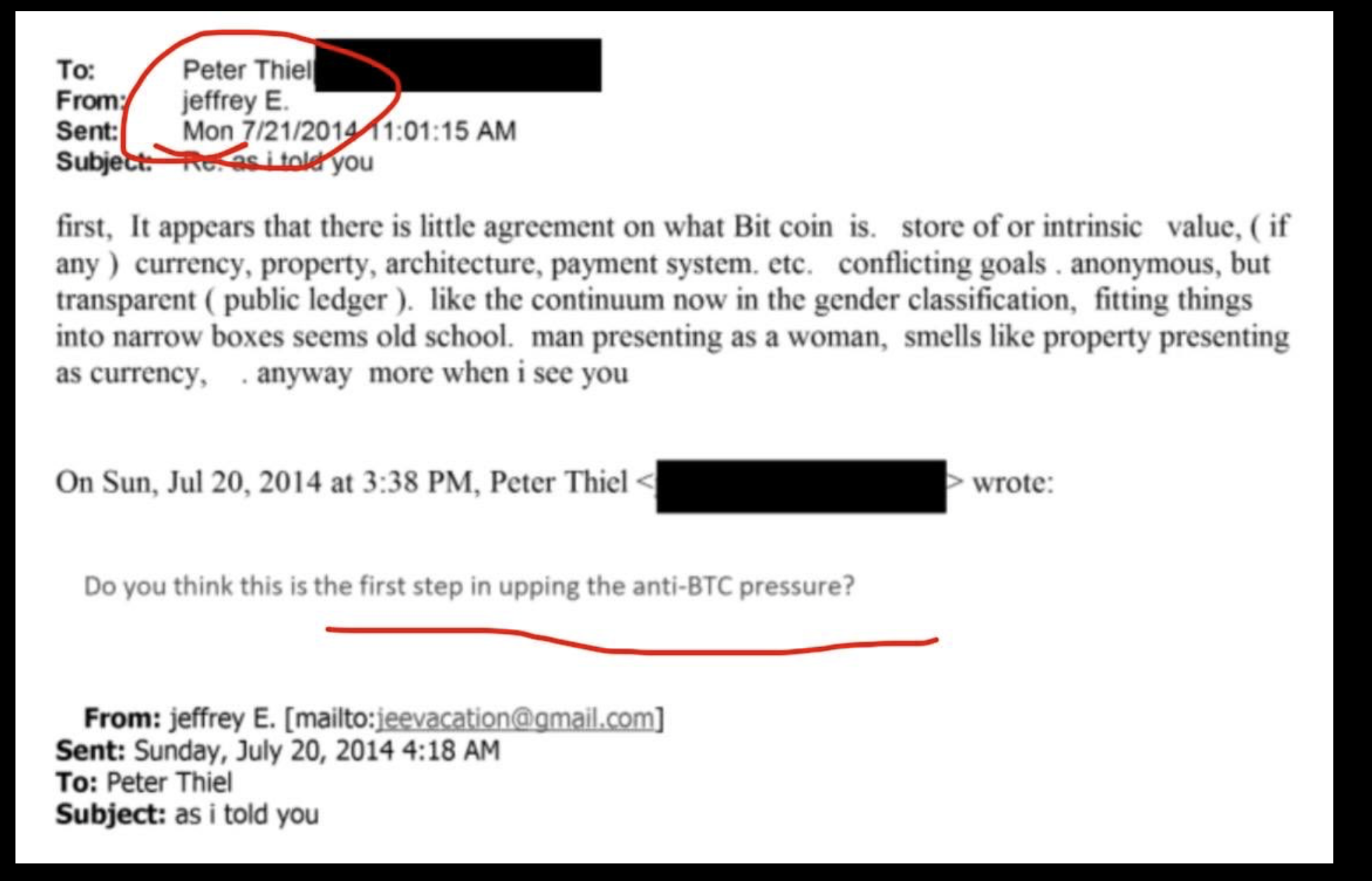

A major "smoking gun" in this narrative is the communication between Jeffrey Epstein and Peter Thiel, where they allegedly discussed a deliberate campaign to confuse the Bitcoin narrative between "store of value" and "medium of exchange." Epstein’s shadow looms large; his funding reportedly entered the space through vehicles like "Digital Garage" to support Blockstream.

Email exchange between Peter Theil & EPSTEIN

The "Payoff Theory" regarding Blockstream suggests they were funded to ensure Bitcoin did not scale as a medium of exchange, protecting the banks until CBDCs were ready. The "Liquid Network"—a federated banking tool—is often viewed as the evidence for this.

I have seen the pressure of these networks firsthand. I recall being cornered in a room for three hours by Brock Pierce, who was desperately trying to persuade me to publicly back Craig Wright as Satoshi. Similarly, in private meetings in China, Jihan Wu of Bitmain was also pushing the Wright narrative. It appears every faction was being influenced to support specific "ops" designed to fracture the community.

"It’s like a mafia where you can never leave... if you stop being an asset, then there are ways of making you disappear."

In these hierarchies, you are either an asset to the Empire or a liability to be removed.

Custody: The Ultimate "Panopticon" Attack Vector

The Empire does not need to hack the protocol if they control the keys. The rise of Bitcoin ETFs and heavy Wall Street involvement is a "rehypothecated nightmare" where history repeats itself. This is exactly how the Gold Standard failed: gold was moved into vaults, replaced by paper contracts, and then rehypothecated into oblivion.

If we allow Wall Street to hold the keys, Bitcoin becomes a "Panopticon coin." Through paper derivatives and regulated custody, the legacy system can effectively default on the 21-million-supply promise by creating "digital fiat" that exists only on a balance sheet, not on the blockchain.

The Open Source Boardroom: Why Bitcoin Still Isn't Hijacked

Despite these immense infiltration attempts, my core counter-argument to Steve Patterson remains: Bitcoin has not been hijacked. The protocol currently functions as an "Open Source Boardroom" with unique checks and balances.

The User Activated Soft Fork (UASF) proved that node power serves as a "veto power" over both developers and miners. While certain developers may have commit access, they cannot force the network to accept code that the nodes reject. This decentralized oversight is what keeps the 21-million supply promise intact. As long as the cost of running a node remains trivial, the community retains the power to fire the developers and the miners alike.

Conclusion: The Sovereign Exit

The realization that our industry has been targeted for co-option is sobering. However, as long as the protocol remains open-source and decentralized, an "exit" still exists. The only true way to bypass the financial prison being built is through self-custody and running your own node.

Is Bitcoin currently a tool for the surveillance state, or is it still our best escape hatch? The answer depends entirely on your willingness to be sovereign.

Simon Dixon vs Steve Patterson – BTC vs BCH Infiltration Debate

Here are comprehensive summary points designed to serve as talking points regarding your interview with Steve Patterson. They are categorized by the major themes covered during the two-hour discussion.

1. The Core Thesis: "Divide and Conquer"

- The Strategy: You argued that the "Hijacking Bitcoin" narrative is not as simple as "Big Blockers vs. Small Blockers." Instead, it was a sophisticated "divide and conquer" strategy by intelligence and state actors to infiltrate both sides of the debate.

- Infiltration of Corporate Entities: While Blockstream is often cited as the villain, you noted that by 2014/2015, almost all major corporate entities (Coinbase, BitPay, Blockchain.info) were on the Big Blocker side, and infiltration likely occurred across the entire corporate spectrum, not just within Core development.

- The Intelligence "Gateway Drug": You proposed that Bitcoin may have been open-sourced by a runaway element of the intelligence community. The state’s interest in it was likely as a "gateway drug" to acclimatize the public to digital architecture, eventually leading to CBDCs and the surveillance state currently being built.

2. The Jeffrey Epstein Connection & Timeline

- 2011 (Early Reconnaissance): You discussed how Epstein immediately tried to identify the key players in Bitcoin in 2011. He attempted to meet Amir Taaki and contacted Gavin Andresen (who publicly declined, though Steve noted Gavin met the CIA around this time).

- 2014 (The Pivotal Year): You identified 2014 as the year the industry changed, akin to the FTX collapse but worse. This involved the bankruptcy of the Bitcoin Foundation, the rise of Blockstream, and the entrance of Silicon Valley venture capital.

- Epstein & Peter Thiel: You highlighted communications between Epstein and Peter Thiel discussing a deliberate campaign to confuse the Bitcoin narrative regarding "store of value" vs. "medium of exchange".

- Blockstream Funding: You and Steve discussed the confirmed funding Blockstream received (via Digital Garage/Reid Hoffman) that was connected to Epstein. You noted Adam Back’s refusal to clarify the nature of his alleged visit to Epstein’s island.

3. Key "Bad Actors" & Compromised Figures

- Brock Pierce: You identified him as a central figure in the infiltration. He was involved in the Bitcoin Foundation, founded Realcoin (which became Tether), and attempted to legitimize Craig Wright as Satoshi. You described his role as someone trying to climb the "compromise hierarchy" to be useful to power.

- Adam Back: You flagged him as a potential bad actor for taking Epstein-affiliated money and refusing to transparently address the conflict of interest or his potential presence on Epstein's island.

- Craig Wright: You and Steve agreed Wright was an "op" designed to fracture the community. You recounted how Brock Pierce tried to corner you into supporting Wright, and how Gavin Andresen provided the credibility Wright needed to disrupt the space.

- Peter Todd: You labeled him a potential bad actor and noted his history of proposing changes to the 21 million hard cap, which Steve fears could eventually be implemented by a potential captured development team.

4. Divergence of Opinion: Gavin Andresen & Roger Ver

- The Gavin Disagreement: Steve views Gavin as a "good egg" who was tricked by intelligence agencies regarding Craig Wright's signature proof. You countered that Gavin’s behavior—specifically admitting he used a laptop provided by the "trickers"—was highly suspicious, suggesting he was either part of the compromise or dangerously incompetent in that moment.

- Roger Ver & Leverage: While Steve defended Roger Ver’s intentions, you suggested the possibility that Ver was compromised via leverage, specifically citing his tax issues and legal troubles as potential pressure points used by the state to steer his actions during the block size wars.

5. Custodial Bitcoin vs. Self-Custody

- The "Panopticon": You agreed that a custodial Bitcoin standard (ETFs, banks) is a trap. Just as paper contracts destroyed the Gold Standard, custodial Bitcoin allows the state to rehypothecate the asset and control the user.

- The "Exit": Despite the gloom, you argued that Bitcoin's true remaining value is self-custody. It remains the only way to hold a bearer asset that allows you to leave a jurisdiction or survive outside the banking system.

- Running a Node: You emphasized the importance of running a node (which Steve questioned the utility of) as a defense mechanism and a way to verify one's own sovereignty in the network.

6. Conclusion: The State of the Industry

- Steve’s Pessimism: Steve concluded that crypto is likely "over" and fully captured, serving as the rails for digital dollars.

- Your Realism: You agreed the world is heading toward a digital Orwellian nightmare, but you maintained that Bitcoin (specifically non-custodial) remains the best available tool for personal liberty and an "exit" from that system.

Take Action & Follow the Money

- Share this post. Share this blog post to expose the "divide and conquer" trap.

- Subscribe to the Simon Dixon YouTube channel. Get my weekly deep dives into geopolitics, macro, and Bitcoin. Subscribe to my YouTube channel.

- Find me on Rumble. This is my backup channel, safe from censorship. Follow me on Rumble.

- Follow me on X @SimonDixonTwitt. I post real-time updates and analysis on X and am highly active there. Follow me on X.

- Follow me on instagram. Usually short clips are posted here.

- Follow me on TikTok. Usually short clips are posted here.

- SimonDixon.com. This is my personal site and an archive of all my content, safe from de-platforming. Join the free membership portal.

Watch on YouTube

Prefer to listen? Available on Spotify and Apple Podcasts

Read other related blogs

Legal Disclaimer

The information provided in this blog post is for informational and entertainment purposes only and does not constitute financial, legal, or tax advice. The contents of this article are based on a specific recorded debate and represent the personal opinions and interpretations of the speakers involved, derived from their long-standing history within the cryptocurrency industry and available public documents. You should not treat any opinion expressed in this post as a specific inducement to make a particular investment or follow a particular strategy.

Bitcoin and other digital assets involve a high degree of risk and significant volatility. The concept of Sovereign Wealth Building requires rigorous individual due diligence and the acceptance of total personal responsibility for all financial decisions, including the practices of self-custody and node operation. The views expressed regarding specific individuals, such as Adam Back, Brock Pierce, Craig Wright, and Peter Todd, or various corporate entities and their alleged associations with figures like Jeffrey Epstein or Peter Thiel, are the subjective conclusions and interpretations of the debate participants and are a matter of public debate and interpretation.

The author and publisher are not responsible for any financial losses, legal consequences, or regulatory issues that may result from the use of the information contained herein. Always consult with a qualified professional before making significant financial moves. Past performance is not indicative of future results, and the rapidly changing nature of technology, geopolitics, and law means that information may become outdated quickly. Taking personal responsibility for your own financial sovereignty is the only way to navigate the risks described in this document.